What is the next Bitcoin? What is the next Ethereum?

These are the two questions most often asked by those unfamiliar with cryptocurrencies and yet seeking to realise the returns advertised by the space.

In truth, there is no next Bitcoin or next Ethereum. What people are really asking is which cryptocurrencies will outperform Bitcoin? Which investments in crypto will provide returns similar to Bitcoin or Ethereum?

Another unfortunate truth is that the answer to the latter is likely nothing, and, if there is such an investment, the likelihood that you will find it, buy it at the lows and hold it all the way until those returns materialise is akin to winning the lottery. However, the former question is a more interesting prospect, as I firmly believe that there are numerous cryptocurrencies that will outperform Bitcoin and Ethereum over the next 12 months; and that in itself would likely provide an outstanding return-on-investment.

In this post, I will provide the top 5 cryptocurrencies I expect to outperform Bitcoin in 2020, selected by coupling fundamental analysis of each with an overview of their price-histories, thus determining their speculative prospects.

The most important consideration here was that each cryptocurrency project have a strong value proposition, sound development, a committed and experienced team and, of course, an attractive price.

Below, I have provided an introduction to each of these cryptocurrencies, as well as an overview of their fundamentals, their price-histories and given a tongue-in-cheek prediction in the conclusion. Note: I do not expect these predictions to be accurate, given the innumerable variables in the cryptocurrency markets; they are provided for reference.

Seeking Out ‘The Next Bitcoin’

Komodo

Fundamental Analysis

Komodo is a cryptocurrency that was launched in Q3 2016 and operates within a multitude of sectors in the market, with aims of providing an end-to-end solution for the development of blockchain infrastructure. Despite its current iteration being in existence for 3 years, its development began in 2014.

As stated on the Komodo About page:

“Today, Komodo focuses on providing business-friendly blockchain solutions that are secure, scalable, interoperable, and adaptable. Komodo’s current technology suite, the Antara framework, offers tools for end-to-end blockchain development, including a customizable, application-specific Smart Chain complete with a library of built-in modules and an open API for building blockchain-based applications.”

In short, Komodo is a plethora of solutions to a number of problems. Critically, it is host to its own ecosystem of tokens, each of which is secured not only by the Komodo network but also by Bitcoin’s due to Komodo’s DPoW consensus mechanism. Further, Komodo is on the breaking edge of use-cases in the space, having developed a decentralised exchange for atomic swaps (with a mobile app), an adaptable framework for blockchain development that is highly customisable (via Smart Chains) and, of course, privacy, by proxy through Piratechain (a native token to its ecosystem).

Given the depth and breadth of developmental progress being made with Komodo, I expect it to cement itself as one of the top blockchain projects in 2020.

Technical Analysis

Price: $0.675 (7,320 satoshis)

Circulating Supply: 116,817,755 KMD

Market Capitalisation: $78.72mn (8,435 BTC)

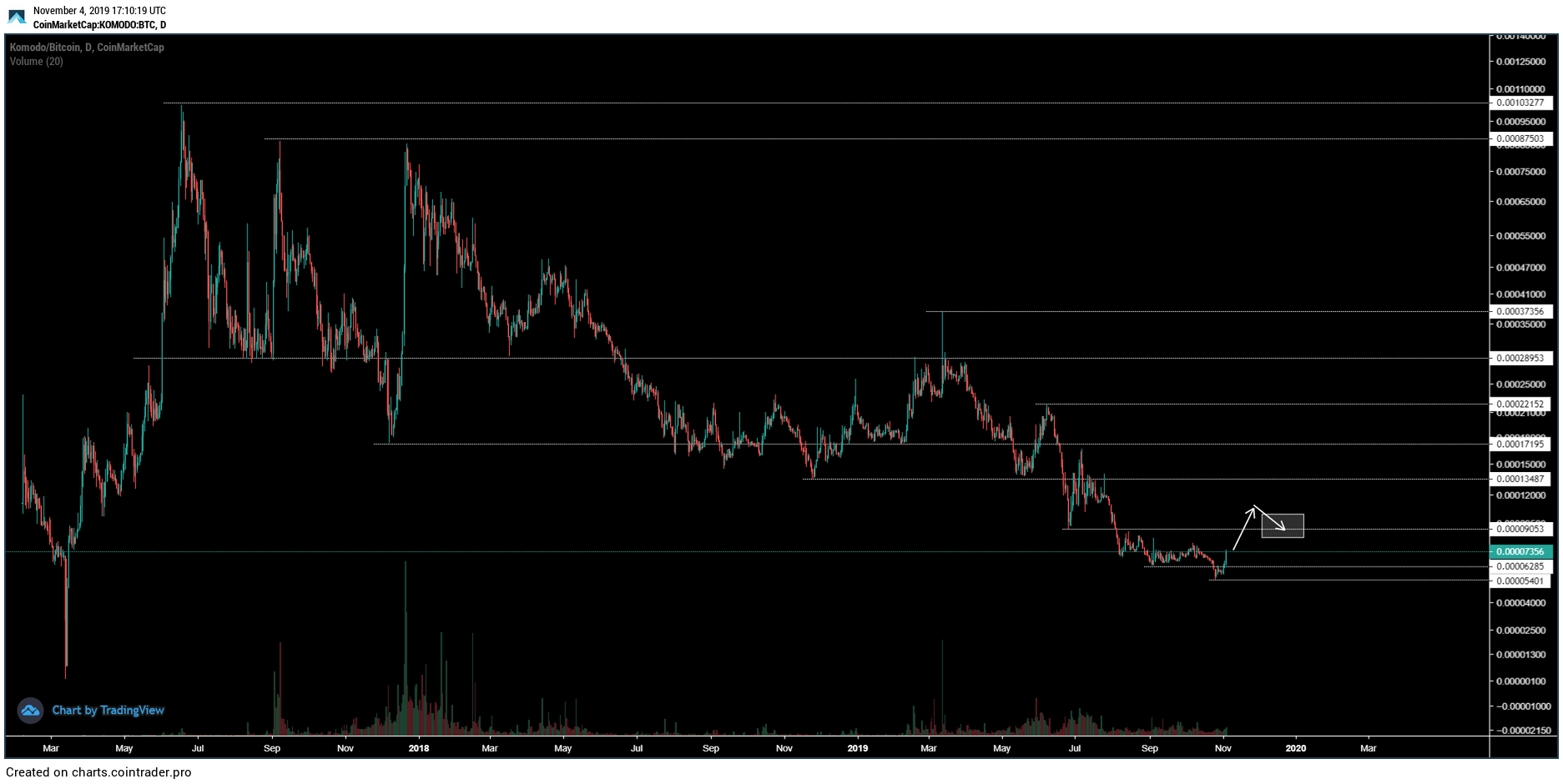

Looking at the KMD/BTC chart above, we can see that price is at levels not seen since March 2017, despite Komodo having progressed significantly in its fundamentals since then; such is the game. Market cycles don’t care about fundamentals, but this plays into our hands, as we now have an opportunity to buy a fundamentally-sound project at historically-cheap prices.

Following Komodo’s listing on exchanges in Q1 2017, it quickly began its first bull cycle, printing an all-time high at 103,000 satoshis in June; a high that remains in place to this day. Price then found support at 29,000 satoshis for a short while before rallying rapidly to 88,000 satoshis, ending the bull cycle and leading to a break of significant support and a cyclical low being made at 17,000 satoshis in the winter of 2017. Price then failed to form an accumulation range at this low, instead sharply reversing and beginning a new bull cycle that printed a double-top at 88,000 satoshis around the New Year.

Following this, we have seen an extended bear market, now almost two years in duration, with price breaking new lows almost every month throughout that period. A range was found in the winter of 2018 between 14,000 and 22,000 satoshis, but a breakout above this range proved to be false, with new lows printing in June 2019, culminating in the most recent low at 5,400 satoshis in October.

I believe this most recent drop-off was likely a ‘spring’, with price having rallied back into the range that has formed between 6,200 and 9,000 satoshis. If price is able to break above this range, a low-risk entry would be to enter on the retest, in the box I have highlighted. However, looking back at the volatility of Komodo’s bull cycles, this may not be a possibility. I have bought a position with an average entry of 7,400 satoshis, as I expect that this will reap rewards in 2020.

Prediction: 30,000 satoshis in 2020

NKN

Fundamental Analysis

NKN is a cryptocurrency that was launched in January 2018 and operates within the network connectivity sector of the market, with aims of improving upon the inefficiencies and poor security of the current client-server model. In their own words:

“We use economic incentives to motivate Internet users to share network connection and utilize unused bandwidth. NKN’s open, efficient and robust networking infrastructure enables application developers to build the decentralized Internet so everyone can enjoy secure, low-cost and universally accessible connectivity.”

NKN stands for New Kind of Network, a name derived from Stephen Wolfram’s A New Kind of Science (who, significantly, is a listed advisor to the project). It raised over $12mn in an ICO shortly after launch, using these funds to continue development of its novel Proof-of-Relay consensus mechanism that facilitates more efficient usage of our network connectivity. Further to Stephen Wolfram’s advisory role, the team also were able to secure Whitfield Diffie as an advisor. Most impressively, having launched its Narwhal mainnet this past summer, NKN now has a larger full node network than Bitcoin, with 22,018 live nodes at present.

NKN considers itself the third pillar of blockchain infrastructure, where Ethereum is decentralised computing; Filecoin is decentralised storage; and NKN is decentralised networking. I am expecting the strength of the network to continue to grow as the service itself comes to the forefront in 2020.

Technical Analysis

Price: $0.028 (305 satoshis)

Circulating Supply: 466,666,666 NKN

Market Capitalisation: $13.224mn (1,417 BTC)

As can be seen from the NKN/BTC chart printed above, price has spent the vast majority of its time in a downtrend, falling off dramatically from the 6,000-satoshi high printed when the coin was first listed. Following listing in June, price crashed to 700 satoshis in August and then formed resistance at 1,350 satoshis, which became a triple-top over the subsequent months, with NKN forming a broad range between a low of 315 satoshis in December 2018 and the 1,350 resistance.

It wasn’t until August that this range support gave way and new lows were formed, with the all-time low printing at 217 satoshis. Since then, NKN has bounced off the bottom on significant volume, rallying to 550 satoshis upon its listing on Binance, which was followed by a move back to 300 satoshis, where it currently sits.

This is a prime area for accumulation, especially given the recent Binance listing and the fundamental quality of the project and I am invested from 270 satoshis. I expect another leg up to follow in the coming months, taking price back above 600 satoshis.

Prediction: 1,500 satoshis in 2020

For further reading, check out my Coin Report on NKN.

V-ID

Fundamental Analysis

V-ID is a cryptocurrency that was conceptualised in 2017 and differs greatly from most in that it is a cash-generative business at its core; a subsidiary of WIDIDI. More uncommon still, the team developed a working product prior to raising funding via private and public sales. It operates within the data validation sector of the market.

They are seeking to become the market leader in file protection and validation, with the V-ID software already having over 30 clients.

As stated in their whitepaper:

“V-ID is built to help prevent document fraud and add value by validating and verifying documents using blockchain technology. Our mission is to safely certify and secure all digital assets, so fraud and errors no longer hold back society’s innovations in digitalization. The service utilizes generic and trusted principles to enable validation and verification for any digital file, of any publisher. This is possible thanks to the immutable and transparent nature of blockchain.”

Most importantly, V-ID is a growing, cash-generative business. with revenues increasing each month. Last month, 1.8mn VIDT was spent on validations; given that the business has a burn mechanism based on revenue, this culminated in 360,000+ VIDT being burned, reducing the circulating supply by over 1%. Further, 1.8mn VIDT equates to $150,000 monthly revenue at current prices, which, when projected forward, gives V-ID annual revenues of $1.8mn, which means that the project is currently trading at ~1.5x annual revenues, with projected supply burn for the next 12 months over 15%.

Technical Analysis

Price: $0.084 (899 satoshis)

Circulating Supply: 30,255,347 VIDT

Market Capitalisation: $2.54mn (272 BTC)

Looking at VIDT/BTC, we can see a textbook market cycle having played out over the course of the past 6 months, with the initial depression (or accumulation) phase having occurred between the all-time low at 565 satoshis and range resistance in May at 1,000 satoshis. Following this, a breakout ensued and V-ID’s first bull cycle began, with disbelief (see the Wall Street Cheat Sheet, for those unfamiliar) coming as price rallied above 1,500 satoshis, culminating in euphoria with an all-time high just shy of 5,000 satoshis.

Since then, price has experienced a bear cycle, moving through complacency back into the original area for accumulation in May 2017, which I now believe is a new depression phase. Unlike the vast majority of altcoins, V-ID actually produces cash flow, which is growing month-on-month. In October, as mentioned in the prior section, V-ID had revenues of ~$150,000; project this forward for 12 months and you have annual revenues of $1.8mn, which would mean that VIDT is currently trading at 1.44x revenues. Further, with each month of growing revenues, more VIDT is burned, artificially decreasing the circulating supply and reducing headwinds for price growth. As such, I am buying VIDT at current prices, in anticipation of a new market cycle beginning in 2020.

Prediction: 6,000 satoshis in 2020

For further reading, check out my Coin Report on V-ID.

Fantom

Fundamental Analysis

Fantom is a Directed Acyclic Graph token that was launched in May 2018 and operates within the smart contracts sector of the market, with aims of solving the scalability issues present in current smart contracts solutions such as Ethereum, as well as building cross-chain asset interoperability.

As stated in their whitepaper:

“The vision of FANTOM is to grant compatibility between all transaction bodies around the world using fast DAG technology that can be deployed at scale in the real world, and to create new infrastructure with high reliability that allows for real-time transactions and data sharing.

FANTOM has the intention of being used on a large scale in various industry verticals, such as telecommunication, finance, logistics, electric vehicle provision and others. The FANTOM Foundation intends to create the FANTOM platform along with a new Smart Contract-based ecosystem that can be used by all current and future partner companies around the world.

To facilitate consistent global transactions with high accuracy and reliability, the FANTOM Foundation will lead the next generation of distributed ledger technologies. The platform intends to be open-source: used and changed by the community, and to provide various application support tools that can be used to create decentralised applications (DApps).”

Regarding the use-cases of Fantom’s technology, the first point to make is that their novel Lachesis protocol improves transaction efficiency to above 300,000 tx/ps, which will facilitate its usage in smart cities, public utilities, banking, healthcare etc. Current partners include Oracle and the South Korea Food Tech Association. The FTM token will be integral in transacting on the network, as well as utilising the cross-chain interoperability that Fantom is currently developing through bridges.

Technical Analysis

Price: $0.014 (148 satoshis)

Circulating Supply: 1,813,658,595 FTM

Market Capitalisation: $25.143mn (2,689 BTC)

Looking at FTM/BTC, we can see some very distinct market cycles. Firstly, upon initial listing, Fantom fell off towards lows of 90 satoshis in February 2019, at which point it formed a base that preceded the first major bull cycle. By April, prices had peaked out at 380 satoshis, before swiftly retracing back to the 100-satoshi area in May. A sharp reversal brought price back above 380 satoshis in June, peaking at an all-time high around 500 satoshis. Since, Fantom has been in a bear market, with successive lower-highs and lower lows, though it appears to have formed a new base at 120 satoshis, which began in October.

If FTM is able to sustain a move above 160 satoshis, I would be convinced that this range was the bottom and that a new bull cycle was ready to begin. Buys on a retest of this breakout provide the lowest risk for longer-term positions going into 2020.

Prediction: 600 satoshis in 2020

For further reading, check out my Coin Report on Fantom.

Constellation

Fundamental Analysis

Constellation is a cryptocurrency that was launched in 2017 via a private sale that raised over $35mn. It operates within the Big Data sector of the market, with aims of making high-volume data exchange trustless, inexpensive and secure, allowing for businesses to both monetise these data streams and drastically improve the efficiency of data transfers.

As stated on the About Us section of their website:

“Constellation is a distributed network that enables fast, scalable solutions for organizations who need to process and transfer data securely and build interoperability for connected sensors and devices. As computing moves increasingly to the edge, Constellation provides the only scalable, secure solution for a world with more connectivity, more centralization, and more concentrated risk.”

Almost unbelievably for a project of its relative recency and market cap, Constellation secured a working partnership with the United States Air Force to assist in solving its organisational issues with the massive amount of data in the USAF’s database, as well as making this data interoperable in the future. Other partners include HyperLedger, MOBI and ChainRock.

Technical Analysis

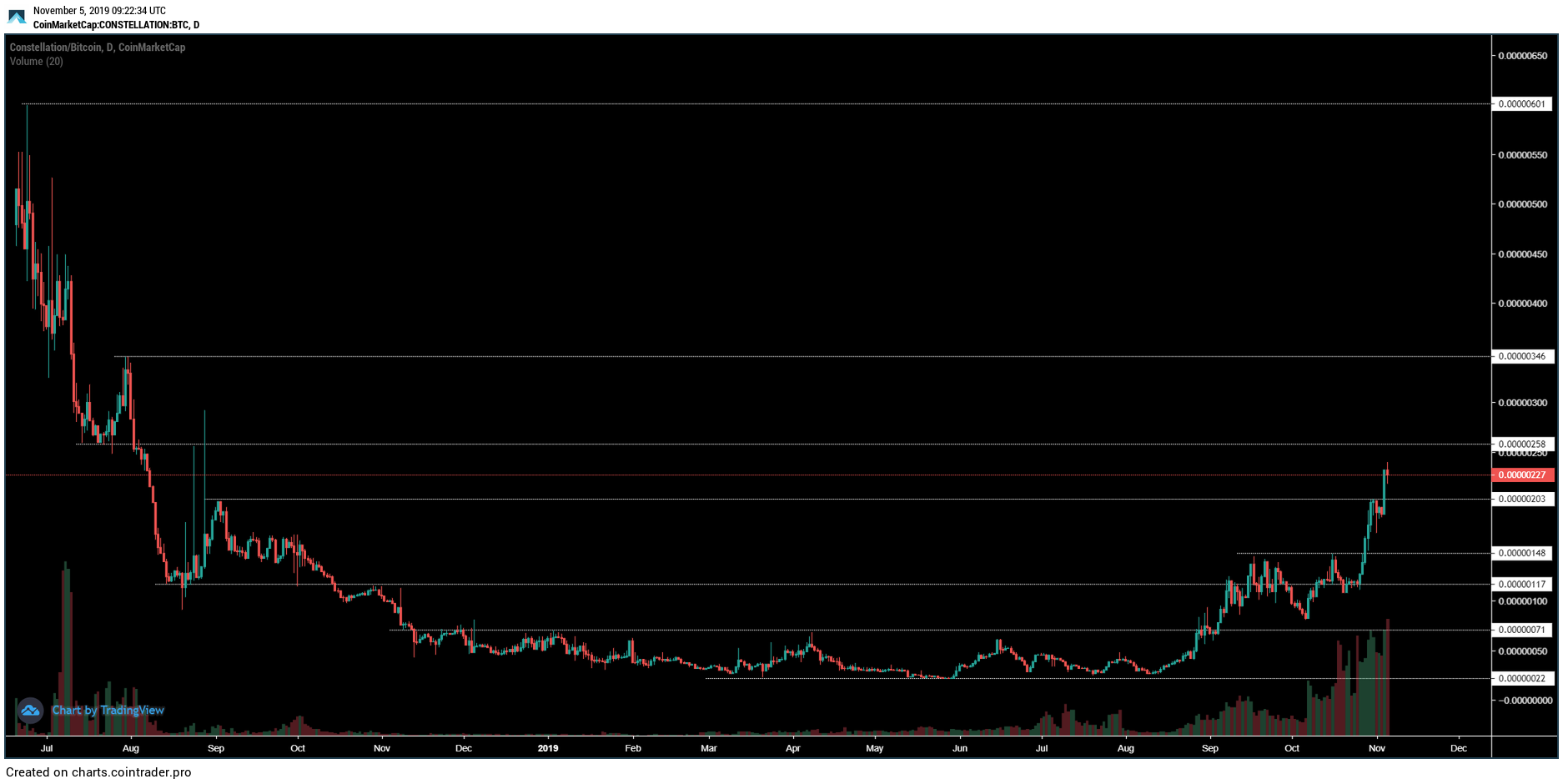

Price: $0.021 (227 satoshis)

Circulating Supply: 868,412,607 DAG

Market Capitalisation: $18.523mn (1,976 BTC)

Unlike other altcoins featured in this post, which are very much in the troughs of their respective bear cycles, Constellation has emerged from its depression phase and appears to now be in the optimism stage of the market cycle. Nonetheless, this is certainly a project I want to be invested in going into 2020, and so I am buying on dips where I can, adding to the original position I bought during the long consolidation period that can be observed on the chart above.

Price has broken out of this range with some conviction, forming new support at the range resistance of 70 satoshis. Following this, new resistance was found at 150 satoshis, which has also since been broken as price rallied into the September 2018 peak of 200 satoshis last week. I would expect a move back to 150 satoshis to flip that prior resistance as new support, providing an excellent entry for those still on the sidelines. Moving into 2020, I am expecting big things from Constellation, with the all-time high that was printed upon initial listing at 600 satoshis firmly in sight. Given that this high was printed during the first few days of trading, I would expect the first full bull cycle to take it out.

Prediction: 750 satoshis in 2020

For further reading, check out my Coin Report on Constellation.

And that concludes this post on the top 5 cryptocurrencies that I expect to outperform Bitcoin in 2020. I hope you’ve found some value in the read. As I mentioned, there simply is no next Bitcoin nor a new Ethereum; instead, all we can hope for is relative outperformance, which in itself – though remarkable – is a very real possibility in this space.

If you have any questions, feel free to leave them below!

Hey Nik – V-ID hit your target today!

Indeed! And still looks strong.

Elastos is getting their OS ready for january, so it could be a very good investment for 2020

What about XYO? What do you believe their performance in 2020 will be like? My best description for it is a geo location data based cryptocurrency. If I remember correctly, they built it with keeping maps accurate and sharing earned coins with other users of the app as a way to help people within your community.

AXE has had a nice little tun since Jan..

Hi Nik,

What about DAG and LINK?

any insights on that.

Thanks

DAG is literally featured in the post, haha. As for LINK, it’s up there, but it’s also much larger than those projects mentioned and this post is about the projects I expect to most significantly outperform Bitcoin, not just the most fundamentally sound.

Zilliqa is the one you’re missing ?

What do you think about HOLO and HBAR?

What about LIT?

Thanks, Mike

Don’t know anything about LIT. I like Holo and HBAR but haven’t done much deep research on either. I also think there are better DAG projects than HBAR at the moment, though it may come into its own considering it laid the groundwork for a lot of them.